Mindfulness practices to overcome money shame and stress

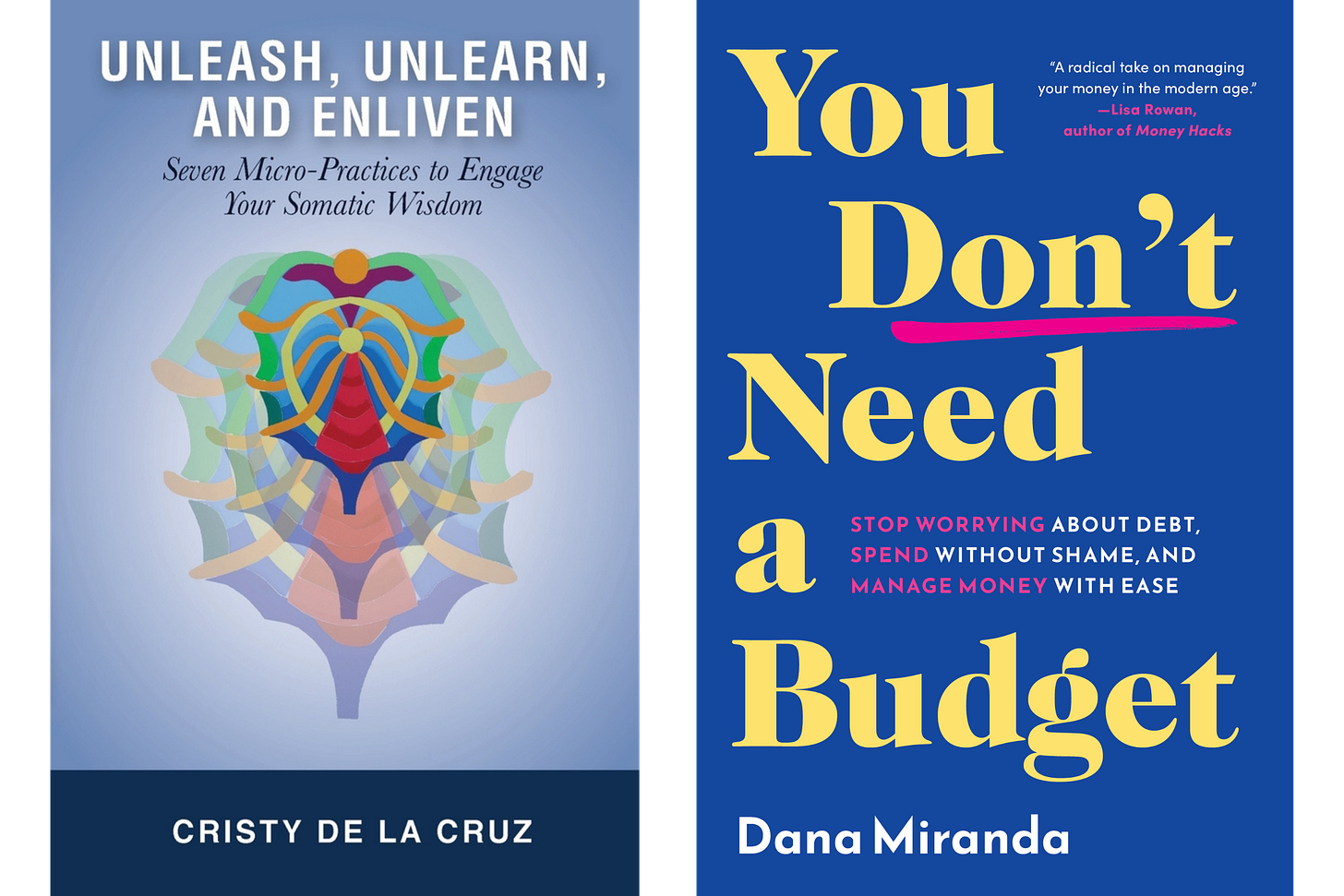

Mental fitness coach Cristy de la Cruz shares techniques to release money shame and quiet overwhelm.

To deal with negative emotions around money, you can fill out worksheets, implement systems and study statistics all day long. Those tools help, but it’s also important to look inward.

Cristy De La Cruz — a somatic educator, coach, author, speaker and the writer of Our Somatic Wisdom newsletter — explains how tuning into the body can help you move through these emotions and shift your relationship with money.

In a conversation with Dana Miranda for Cristy’s podcast, Our Somatic Wisdom, she takes questions from the Healthy Rich community to break down the roots of these emotions and share simple mindfulness practices anyone can use to start healing.

Listen to Dana’s conversation with Cristy de la Cruz:

Catch the summary of their earlier conversation:

How to acknowledge and move through money shame

In ancient tribal settings, shame served an evolutionary purpose: It enforced norms, encouraged cohesion and discouraged harmful behaviors.

Today, we’re still mammals, and we’re still wired for the emotion — but it no longer serves us in the same way, Cristy explains.

If you feel shame around money, the first step is to acknowledge you’re not the only one.

“Recognize the fact that we are living under systems that use shame, ironically, as a motivating force, even though it doesn’t motivate anyone,” Cristy says.

When you clamp down on shame and keep it buried inside, it only grows. Author and shame researcher Brené Brown famously describes shame as the growth in a Petri dish: cover it with judgment, silence and secrecy, and it multiplies.

Rather than sitting in this toxic emotion, acknowledge it. Let it move through you. Then take small, gentle steps toward your financial goals.

So how do you begin? Start by noticing how shame feels in your body, says Cristy — because it shows up differently for everyone.

Close your eyes and take a deep breath. Notice where the feeling bubbles up in your body: your shoulders, hips, stomach, jaw. Keep breathing as you scan your body.

“That simple action can really just say, ‘It’s not me. I’m not the person who’s wrong. There’s just an emotion that’s lodged somewhere in my body,’” Cristy says. “It depersonalizes [shame].”

Although this sounds like a simple practice, Cristy notes it’s advanced, so it’s normal if you need time to get comfortable with it.

“In the beginning, it takes a little time, because we’re not familiar with it,” she says. “Nine times out of 10, we’re going to push it away because the emotion we least want to feel is shame.”

The key is self-compassion. Remember: Money is hard for everyone.

“Our systems are designed in a way to keep people trapped,” Cristy says. “It’s bigger than you, so don’t take all that blame. It doesn’t belong to you.”

Overcoming money overwhelm

Overwhelm can be just as detrimental as shame, and it often stems from what Cristy calls “internal saboteurs,” the judge or critic voice most people carry.

Again, the first step is to recognize the stories your mind spins up: I’m not good at this. I’m bad with numbers. I’m never going to figure this out.

“That’s not you,” Cristy says. “That’s a saboteur. We have to set it on the shelf.”

She even has a name for hers: “the dictator.” When she wants to focus on her money map, for example, she sets the dictator on a shelf so she can focus.

From there, start small. Give yourself just five to 10 minutes with a task — then celebrate. Take a walk, dance to your favorite song or have a treat. You can also loop in an accountability partner to share wins and build momentum together.

“Very often [with money management], people will put it off and put it off and put it off, then it’s a mountain of shame that grows on top of that,” Cristy says. “Allow yourself to build that habit of taking the small step.”

Once you take that small step, the fear often shrinks. You may even find you want to keep going beyond those initial 10 minutes.

“Once you realize it’s not so scary, you start to realize you can keep going back to it, and the judgement gets less and less over time,” she says. “It’s a practice.”

Little by little, these practices can help you build a healthier, kinder way to approach money.